Where To Invest Money In Pakistan

Every successful investor starts with the basics. Anyone with a small amount of savings can start investing through the various investment vehicles available in the market. It is important to remember that investment unlike gambling is not a get-rich-quick scheme and requires a long-term commitment.

Year after year, we hear stories about people of very modest means who start investing over a long period of time reaching financial security, and goals such as: buying a house, paying for a child's college education, and a comfortable retirement.

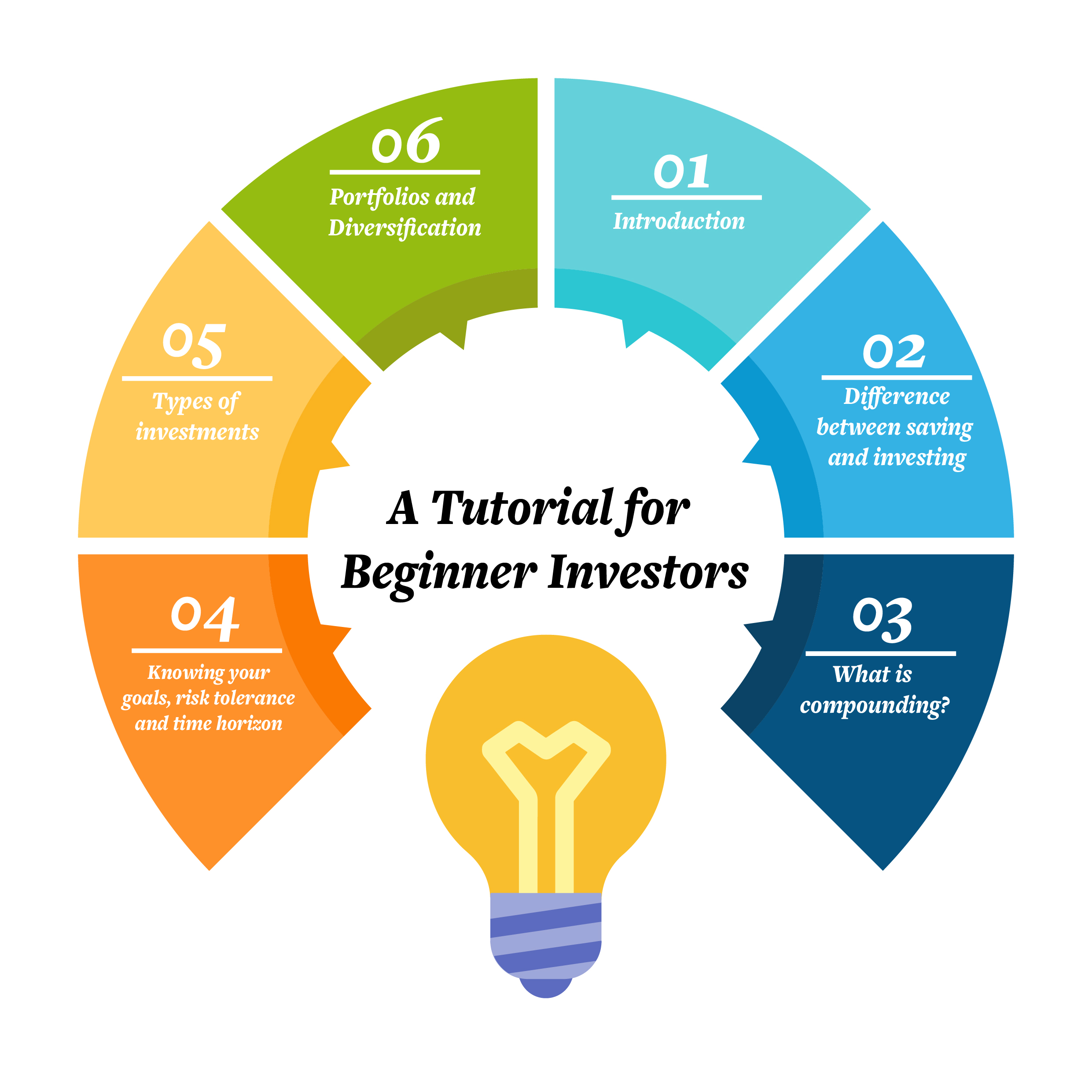

Through these lessons, we will help you understand the investment process, the miracle of compounding, investment strategies and the types of investment products available in the marketplace. After you have finished reading these lessons, please visit our knowledge center to acquire deeper understanding about these topics.

Lesson 1

Saving and investing

Generally one places savings in a product or scheme that allows ready access to funds on an as and when needed basis. However, the tradeoff for ready access is lower returns. Savings products may include savings accounts, chequing accounts (earning low interest) and certificates of deposit. It is always advisable to set aside savings to cover a personally benchmarked sustenance period in case of emergencies such as sudden unemployment, medical illnesses etc.

Money left in ordinary savings account with a bank will not keep up with inflation. Simply put, inflation is the rise in prices relative to money available. For example, if you save Rs.100 today that can buy a kilo of rice, years later if you withdraw that the Rs.100 plus interest earned on it, you may only be able to buy half a kilo of rice. For this reason, people look to investing so that they can counter the effects of inflation, and earn more over a longer period of time.

However, one must realize that money invested in securities, mutual funds, and other similar investments may earn you better returns but your decision to do so carries more risk.

Lesson 2

What is compounding?

Compounding is generally defined as the process of generating more return on an asset's reinvested earnings: to work, it requires two things, the reinvestment of earnings and time. This rapid growth takes place because the total earnings along with the original principal amount invested, earn money in the next period. It is the best investment tool available for young investors. This phenomenon based on the time value of money is also known as compound interest.

Example:

How much does your daily soft drink cost? Would you believe Rs.466 or more?

If you buy a soft drink every day for assuming Rs1, it adds up to Rs. 365 a year. If you saved the Rs. 365 and put it into an investment that earns 5% a year, it would grow to Rs. 466 by the end of five years, and by the end of 30 years to Rs. 1577.50 Over time, even a small amount saved can add up to a large sum of money.

Lesson 3

Knowing your goals, risk tolerance, and time horizon

We all have different goals, risk tolerance, and a time horizon; your investment strategy will be guided by your individual circumstances.

Goals

What are your goals for investing? Are you trying to accumulate money for a comfortable retirement or college education for your children? It is important to understand why you are investing, and the result that you want. However, before investing any money it is important to know your risk tolerance.

Risk tolerance

All investments involve risk in one way or another. How much of a decline in the value of your investment can you tolerate? You should have a realistic understanding of your financial ability to withstand large swings in the value of your investments. If you take on too much risk, you could panic in a market decline, and sell at the wrong time. Your risk tolerance is dependent on when you need the money.

Time horizon

In general, you should have a long-term horizon to recover fluctuations in the value of your investments. Your time horizon is dependent on your age. For example, younger investors who are in their 20's or 30's while saving for retirement can better weather fluctuations in the value of their investments due to their long time horizon. Accordingly, they can take on a bit more risk.

Older investors who are over 60 years of age have less time to recoup their losses in the market and should not take on too much risk. Your investments should match the time horizon during which you will need the money.

You may have heard about day traders who buy and sell stocks on a daily basis, sometimes winning and other times losing money. This may be fine for professionals but never a good idea for the average investor.

Lesson 4

Types of investments

There are many different types of investments available in the marketplace such as individual stocks, bonds, mutual funds and other alternative investments. For our lesson, we will discuss stocks, bonds, and mutual funds.

Stock

Also known as shares or equity. A stock is a type of security that gives you ownership in a corporation and represents a claim on part of the corporation's assets and earnings. There are two types of stock: common and preferred. Common stock entitles the owner to vote at shareholders meetings and to receive dividends. Preferred stock does not have voting rights but receives dividends before common shareholders, has a preferential claim on the company's assets if the company goes bankrupt and is liquidated.

Bonds

When you purchase a bond, you are effectively lending money in exchange for periodic interest payments plus the return of the bond's face value when the bond matures. Governments and corporations issue bonds to raise money. Here are some of the terms used with respect to bonds:

- Face value is the amount of money the bond will be worth at maturity

- Coupon rate is the rate of interest the bond issuer will pay on the face value of the bond. For example, a 5% annual coupon rate means that bondholders will receive Rs.50 every year (5% x Rs.1000 face value = Rs.50).

- Coupon dates are the dates on which the bond issuer will make interest payments. Typical intervals are annual or semi-annual (every 6-months) coupon payments.

- Maturity date is the date on which the bond will mature and the bond issuer will pay the bondholder the face value of the bond.

- Issue price is the price at which the bond issuer originally sells the bonds

Because fixed-rate interest bonds pay the same interest rate over time, their market price will move up and down with changes in the prevailing interest rates. The price of a bond moves in the opposite direction than market interest rates—like opposing ends of a seesaw. When interest rates go up, the price of the bond goes down; when interest rates go down, the bond's price goes up.

For example, if a bondholder purchases Rs.1000 bond when prevailing interest rates are 5%, the bondholder will receive Rs.50 interest income annually. However, if interest rates in the economy drop to 4%, the bond will continue paying 5% coupon rates, making it a more attractive option. Investors will be willing to pay a higher price for these bonds until the effective rate is 5%. On the other hand, if interest rates rise to 6%, the 5% coupon is no longer attractive and investors will be willing to pay a lower price for the bond until its effective rate is 6%.

Bonds can be classified into a fixed rate or floating/variable rate. In Pakistan, either the government or the corporate sector issues bonds.

Government Bonds

The different types of bond products available in the marketplace include:

- Pakistan Investment Bonds (PIBs) are long-term, coupon bearing instruments with semi-annual (six monthly) coupon payments with maturities up to 10 Years. State Bank of Pakistan issues bonds in multiples of Rs. 100,000. Auction schedules and targets for fresh PIBs issuance are announced on a quarterly basis.

- Treasury Bills are short-term, liquid zero-coupon government debt instruments sold at discount to face value with terms of up to 1 year. Auction conducted by SBP on a fortnightly basis.

- Ijarah Sukuk are low risk medium term investment instruments with floating coupon payments issued and guaranteed by the government of Pakistan. They pay semi-annual profit and are Shariah compliant

Other types of government bonds include National Saving Bonds and WAPDA Bonds.

Corporate Bonds

A corporate bond is a debt security issued by a company to meet its financial requirements. In Pakistan, these are commonly known as Term Finance Certificates (TFCs) and are normally issued for a specified period, with an assurance for return of principal amount of the certificate plus interest to the certificate holder.

Mutual funds

A mutual fund is a collective investment scheme that pools money from many investors. The money is managed by an asset management company (AMC) duly licensed by the Securities and Exchange Commission of Pakistan (SECP). A majority of mutual funds in Pakistan are open-end funds which create and sell new units on a continuous basis to accommodate new investors. The money is invested by the asset management company on behalf of the unitholders in a portfolio of securities or other financial assets for profits and income.

Under the regulations, an independent trustee registered with the SECP has custody of all mutual fund assets. The trustee is obligated to ensure that AMC Invests the fund's assets in accordance with the approved investment policy and authorized investments of the mutual fund.

Distinguishing characteristics of mutual funds include the following:

- Mutual fund units are purchased from the fund itself (or through a distribution agent for the fund) instead of from other investors on a secondary market, such as the PSX.

- The investment portfolios of mutual funds are managed by separate entities known as "asset management companies (AMCs)" that are licensed by the Securities and Exchange Commission of Pakistan.

- Under the regulations, an independent trustee registered with the SECP has custody of all mutual fund assets.

- Each unit/share represents an investor's proportionate ownership of the fund's undivided portfolio; each unitholder shares equally with other investors in distributions.

- Price paid for mutual fund units is the net asset value (NAV) per unit and any sales load.

- Unlike other securities, there is always a willing buyer for your units; an open-end mutual fund must redeem shares at the net asset value, meaning investors can sell their shares back to the fund.

Majority of the income earned by the mutual fund's portfolio is given back to the investors/ unit holders as illustrated below:

Lesson 5:

Portfolios and Diversification

An investment portfolio is a collection of investments made to help investors achieve their goals and to provide a certain degree of diversification. An investment portfolio combines asset classes such as stocks, bonds, and cash. These can be further divided into sub-asset classes such as stocks of large, medium, small and international companies. On the bond side, you might have some short-term bonds, intermediate-term, and long-term bonds. Ideally, a portfolio consists of a variety of investments that are not highly related to each other.

Diversification is a strategy that can be summed up by the timeless saying "Do not put all your eggs in one basket." The strategy involves investing your money in various types of investments in the hope that if one investment loses money, the other investments will more than make up for those losses.

Lesson 6:

Have an Investment Strategy

Through these six lessons, we have introduced and discussed a number of investment concepts and products for the beginner investor. It is important to remember that your investment strategy will depend on your goals. Your goals determine your time horizon, which in turn dictates how much risk you can tolerate. Have a plan and a strategy. Please note that if you cannot spend time on your investments get an advisor. If you have savings and wish to start investing today, please read "How to invest in mutual funds?" which is available on this link: https://jamapunji.pk/knowledge-center/how-invest-mutual-funds.

Where To Invest Money In Pakistan

Source: https://jamapunji.pk/financial-planning/investors-tutorial

Posted by: nealromble.blogspot.com

0 Response to "Where To Invest Money In Pakistan"

Post a Comment